How To Roll Over Your 401(k) To A Gold IRA

The volatile market and unstable economy that we’ve experienced over the last few years has been driving many investors into rolling over their 401(k) into gold to protect their savings and future financial success . Converting your 401(k) into gold can be easy and straightforward. Here’s how to convert your 401k into gold (or other precious metals):

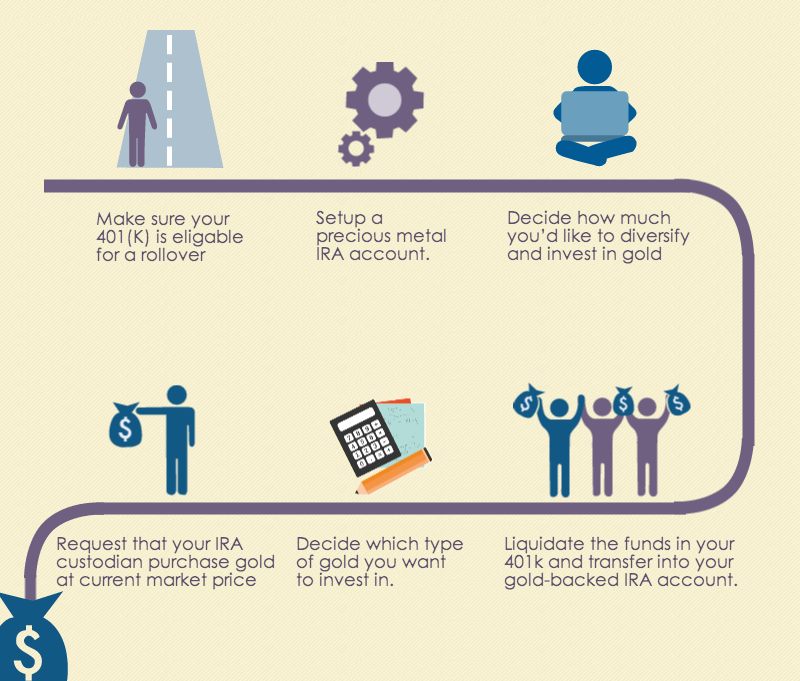

6 Simple Steps To Setting Up Your Gold Retirement Plan

1. Make sure your 401k is eligible for the rollover. Generally, your 401k is eligible if you are no longer working for the employer offering the plan — or if you are older than 59. You can talk to a precious metal specialist to learn more about your available options (click here to visit The #1 Rated IRA Company.)

2. Set up a precious metal IRA account. Continue enjoying the same tax benefits as any other retirement account that is approved by the government.

3. Decide how much you’d like to diversify and invest in gold. You can choose to invest the total amount or any part of it and diversify with other investments. Talk to a Gold IRA specialist to learn more about your available options.

4. It’s paperwork time. Liquidate the funds in your 401k and transfer into your gold-backed IRA account. Since the funds are transferred between eligible retirement accounts, there are no tax-penalties.

5. Decide which type of gold you want to invest in, like bullion or proof gold coins. Diversify your IRA by investing in other precious metals such as silver, platinum and palladium. Make sure to talk to a precious metal specialist before making an investment.

6. Get started. Simply request that your IRA custodian purchase gold (or other precious metals such as Palladium, Silver or Platinum) at current market price through the precious metal company that you have chosen to work with. Once purchased, your gold investments will be sent for secure storage in allocated or un-allocated accounts in an approved metal depository or vault.

(7). Here’s what to do next: As with any investment we think it’s important that you’re comfortable and have a clear understanding of what you are doing. Research precious metal companies and precious metal IRA specialists, read reviews and ask lots of questions during your initial (often free) consultation.