How A Physical Gold IRA Can Protect Your Wealth

Interested in buying gold but need a little more information? This is a great place to start.

A simplified but extensive guide on everything you need to know about investing in gold:

How A Physical Gold IRA (Individual Retirement Account) Can Protect Your Wealth

A Gold IRA is a Self-Directed Individual Retirment Account that allows you to safely own physical precious metals. Why invest in gold? There’s basically three reasons:

1. Gold limits exposure from Wall Street

Gold is a financial asset that doesn’t depend on credit to function. Having physical ownership of precious metals lowers overall portfolio risk by diversifying assets from paper.

2. Gold creates protection for your portfolio

Gold is a tangible asset with a value that has no counterparty or credit risk. It’s stored at IRS-approved depositories and is therefor fully insured. Last but not least gold has been a store of wealth for thousands of years and has outlasted the worlds currencies. Takeaway: Gold will never go out of business or rely on decisions of a company’s officers.

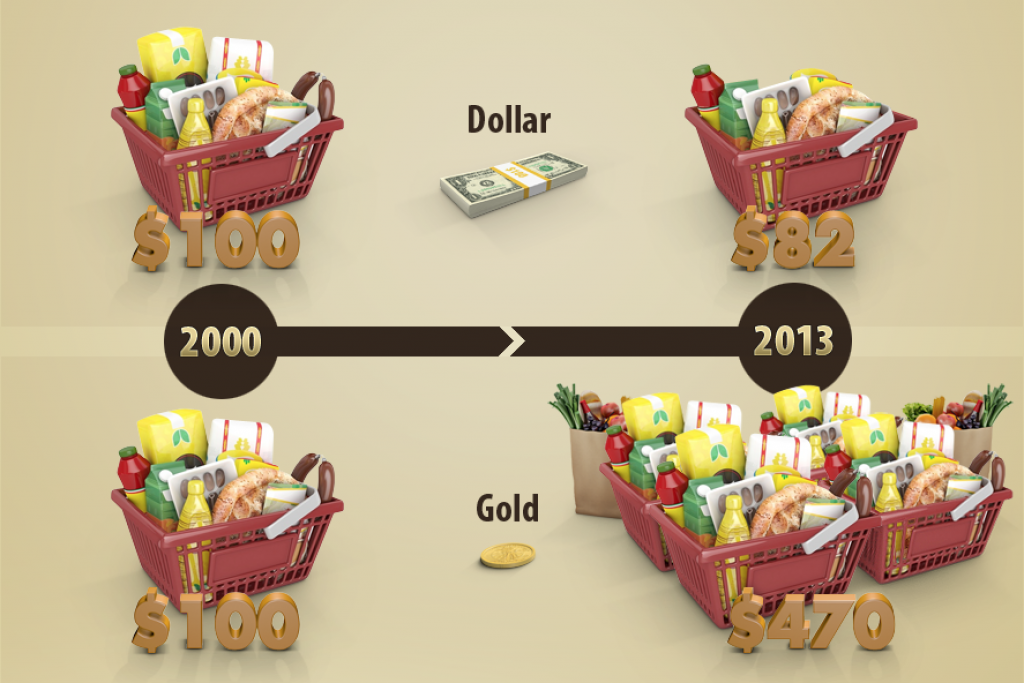

3. The dollar does not buy what it used to

The federal reserve money supply has doubled from 2008 to 2013, and as a result, paper U.S. dollars buy fewer goods and services.

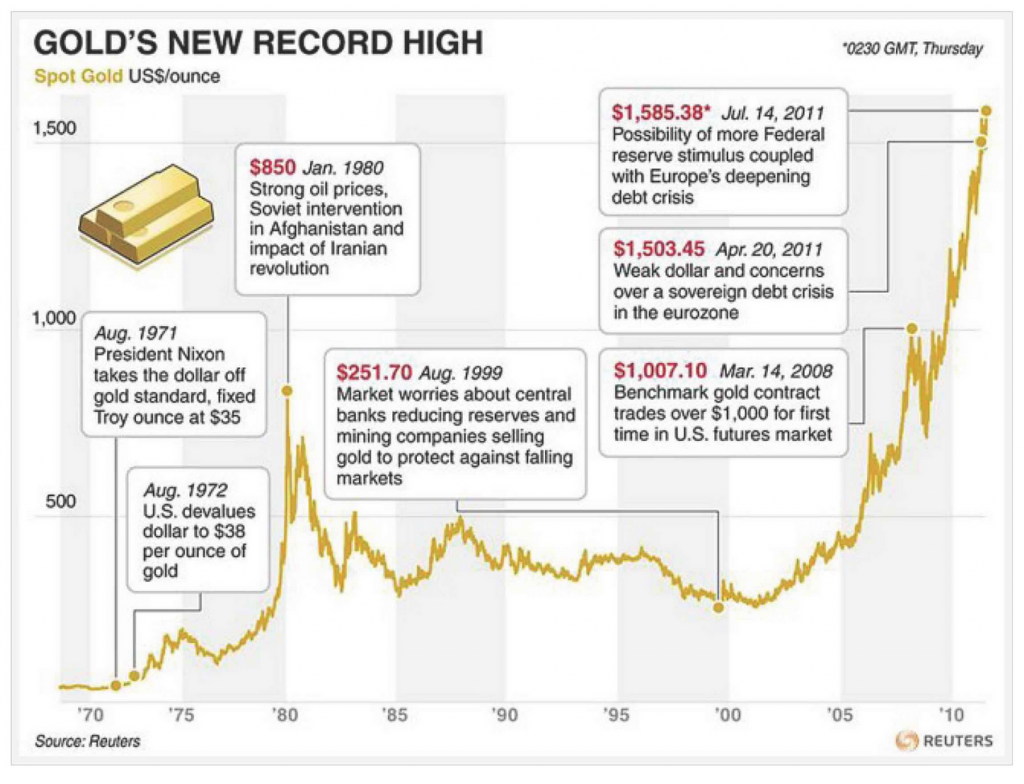

Gold, on the other hand, has steadily increased in value by 4.7 times between 2000 and 2013. Historically, physical gold has been a great hedge against inflation and is a proven safe haven from economic uncertainty. Similary, gold has actually outperformed the three major U.S. indices:

1. Liquidity

Gold can readily be converted into cash when needed because it’s a globally recognized currency.

In fact, gold’s value has been endured for centuries while the worlds reserve currency has changed practically every century.

2. Global Demand

Gold demand is at an all-time-high. India made the largest gold purchase in history and imported 400 tones of gold in Q2 2013.That’s almost half of TOTAL IMPORTS in the entire 2012.

3. Diversification

Phsyical gold offers true diversification, solid protection and excellent profit potential.

A portfolio weighted with 50% in physical gold would have lowered the overall risk and increased returns by +246% compared to the S&P 500. Investing across uncorrelated asset classes is the key to true diversification.

Follow these 3 simple steps to convert your IRA or former 401(K) into a gold asset

1. Open

Contact and complete an application with a listed U.S. Gold IRA Company or Mint dealer who specializes in Gold IRA Rollovers. Most retirement plans qualify.

2. Transfer/Rollover

Once you complete the Direct Transfer or Rollover form, a request is submitted to roll over your funds directly into your new Gold IRA in a lateral tax-free transaction.

3. Own Gold

Once funds are transferred, you choose your portfolio of gold, silver, platinum or palladium. Your purchase is authorized and the metals are shipped.

Getting started & learn even more:

Request a free gold investor kit from Regal Assets (#1 rated Gold IRA company).

Your Guide Includes…

- Discover the closely-guarded secrets of the precious metals industry, and gain an edge over gold sellers before you contact them.

- Learn how gold could not only safeguard your financial portfolio, but could DOUBLE or TRIPLE your savings in the next 1-2 years.

- Unlimited access to your personal gold investment advisor. We are here to answer all your questions and guide you in the right direction. Our mission is to arm you with the information you need to make your own decision about gold investment.